ICT Swing High and Swing Low Explained — Complete Beginner’s Guide 2026

- Published On: 24/01/2026

Join Our Telegram Channel

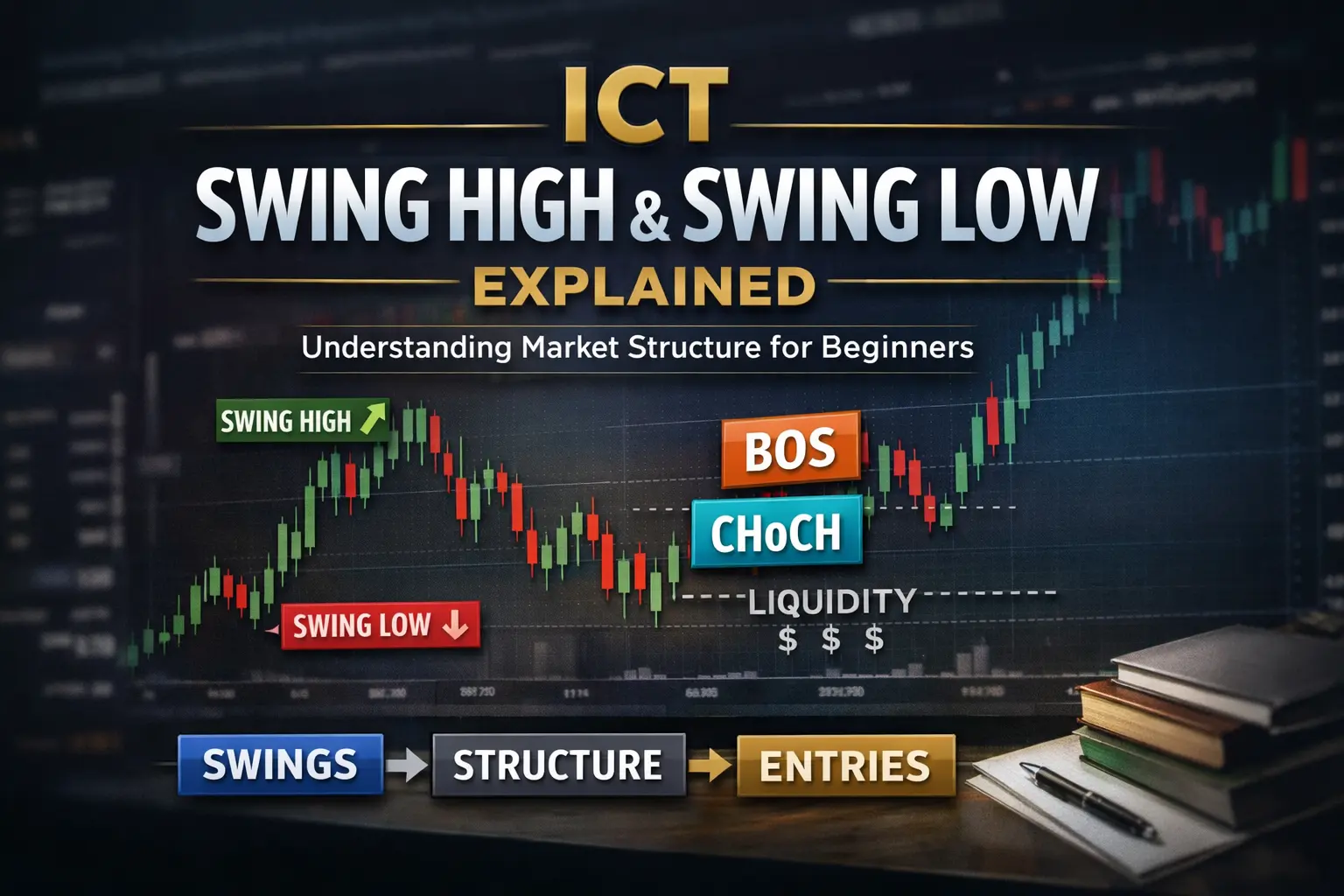

If you’re honest with yourself, you probably didn’t struggle with ICT because entries were hard. You struggled because nothing on the chart made sense. One moment price looked bullish, the next moment it looked bearish. You watched videos about BOS, CHoCH, liquidity, and Fair Value Gaps — but when you opened your own chart, everything felt confusing and disconnected.

This is where most beginners get stuck.

The real problem is not the setup. It’s not the strategy. It’s that swing highs and swing lows are marked incorrectly — or not understood at all.

When swings are wrong, everything breaks. BOS looks random. CHoCH appears everywhere. Liquidity feels like manipulation. Entries feel late, stressful, or unlucky.

Swing highs and swing lows are the foundation of ICT market structure. They show where price actually changed direction with intent. They reveal who was in control and when that control shifted. If swings are unclear, the market story becomes noise.

Many beginners try to shortcut this process. They jump straight to indicators, entry models, or confirmations, hoping something will “click.” But ICT does not start with entries. It starts with seeing price clearly. And clear vision begins with correct swing structure.

This guide is written to slow things down and fix the real issue. You’ll learn what a swing high and swing low actually mean in ICT, how to tell valid swings from noise, and why institutions respect these levels. Once swings make sense, structure becomes obvious — and everything else starts to connect naturally.

Before you think about entries, you must understand structure. Before structure, you must understand swings.

That’s exactly what this guide will help you do.

In ICT trading, a swing high and a swing low are not random candles or small pauses in price. They are points where price clearly changed direction with intent. A swing high is formed when price moves up, slows down, and then decisively moves lower. A swing low is formed when price moves down, pauses, and then pushes higher with strength.

The key difference between a real swing and a random candle is reaction. Random candles come and go without meaning. A true swing causes price to respond. It holds, rejects, or becomes a reference point that price respects later. If price ignores a level easily, it was never a meaningful swing to begin with.

In ICT, swings are important because they represent institutional decisions. Large players do not enter or exit positions randomly. When price turns strongly from a level, it often means institutions have defended price, taken profits, or shifted their intent. Swings show where control was held and where it may have changed.

This is why ICT traders do not look at swings as chart patterns. Swings are not about shapes or candle counts. They are about who was in control of price and whether that control is still valid. A higher swing high shows buyers remain strong. A lower swing low shows sellers are still dominant.

When you understand swings this way, market structure becomes logical instead of confusing. You stop reacting to every candle and start reading price as a story of control, pressure, and decision-making. That is the real purpose of swing highs and swing lows in ICT.

ICT does not rely on indicators because indicators are built from past price data. They react after price has already moved. This makes traders late, hesitant, and dependent on signals. Swing highs and swing lows work differently. They are not reactions — they are explanations of what price has already decided.

Swings show intent, strength, and weakness directly on the chart. A strong swing high tells you sellers stepped in with authority. A strong swing low tells you buyers defended price with conviction. This information comes straight from price itself, without delay, calculation, or interpretation.

Institutions respect swings because swings are created by real order flow. Large players build positions, defend levels, and shift bias around key highs and lows. They do not care about moving averages or oscillators. They care about where price last failed, where it was defended, and where control changed. That is exactly what swings reveal.

This is also why swing-based structure works on all markets and all timeframes. Forex, indices, gold, or crypto — price still moves through decision points. Human behavior, liquidity, and institutional execution do not change just because the market does.

When you stop asking indicators what to do and start reading swings, trading becomes clearer, calmer, and more logical. ICT uses swings because they explain the market — not because they predict it.

This is the section where most traders either fix their understanding of ICT market structure — or stay confused forever. Swing highs and swing lows only work when they are marked correctly. If swings are forced, everything built on top of them collapses.

A valid swing is not something you decide emotionally. It is something price clearly shows you. Institutions leave behind obvious decision points. You don’t need indicators to see them — you need patience and honesty.

A simple rule to remember:

If you have to convince yourself it’s a swing, it’s probably not a swing.

Valid swings are clear even at a quick glance. They stand out without zooming in or drawing extra lines. Invalid swings usually appear when traders are impatient or trying to force structure to match a bias.

Characteristics of a valid swing:

Characteristics of an invalid swing:

Timeframe relevance also matters. A swing that looks important on the 1-minute chart may mean nothing on the 1-hour or 4-hour chart. ICT always prioritizes higher-timeframe swings for structure and narrative. Lower timeframes are used for refinement, not decision-making.

Most beginners struggle because they mark too many swings. When everything becomes a swing, structure loses meaning. Fewer, cleaner swings create more clarity than dozens of forced ones.

Once you learn to respect only valid swings, BOS and CHoCH stop appearing randomly. Liquidity targets become clearer. And price finally starts to make sense.

Not all swing highs and swing lows are equal. In ICT, some swings are considered strong, while others are considered weak. Understanding this difference changes how you read bias, patience, and liquidity behavior.

A strong swing high or low is one that price has clearly respected. When price moves away from a level with strength and does not immediately return to break it, that level shows control. Strong swings suggest that the side defending that level — buyers at a low or sellers at a high — still has influence.

A weak swing is different. Weak highs and lows are levels that price is likely to revisit. They often form when price moves away quickly but leaves unfinished business behind. These swings usually sit in obvious places where many traders place stop losses.

A simple way to think about it:

Strong swings are defended. Weak swings are hunted.

Institutions target weak swings because that is where liquidity is resting. Stops from retail traders collect above weak highs and below weak lows. Price is often drawn to these areas not to reverse immediately, but to fill orders. What looks like a fake move is usually a liquidity grab.

This relationship between weak swings and liquidity is critical. When you see price moving toward a weak high or low, you stop panicking. You stop chasing breakouts. Instead, you understand that price may be seeking stops before the real move begins.

Strong and weak swings also help define bias and patience. If price keeps respecting strong lows, bullish bias remains valid. If weak highs keep getting taken, continuation becomes more likely. You wait instead of guessing.

When you learn to identify strong versus weak swings, the market stops feeling emotional. You begin to see intention instead of chaos.

Market structure in ICT is built directly from swing highs and swing lows. If swings are correct, structure becomes clear. If swings are wrong, structure collapses. There is no shortcut around this.

Trends are created through a simple sequence of swings. In a bullish market, price forms higher highs and higher lows. Buyers are in control, defending price at higher levels each time. In a bearish market, price forms lower highs and lower lows. Sellers are dominant, pushing price down and rejecting higher levels.

This logic sounds simple, but it only works when swings are marked correctly. If random candles are treated as swings, structure becomes inconsistent. Bias flips constantly. Traders feel confused and start doubting every move.

A useful way to understand structure is the staircase analogy:

In an uptrend, price climbs like a staircase — step up, pause, step up again. In a downtrend, the staircase goes downward. If the steps are unclear, you don’t know which direction you’re moving.

Each step of that staircase is a swing. The swings define the path price is taking. When price stops making higher highs or fails to hold higher lows, the staircase weakens. That is often the first sign of structural change.

This is why structure collapses when swings are wrong. If the “steps” are forced or imagined, the entire staircase becomes unstable. BOS and CHoCH signals lose meaning because they are built on incorrect reference points.

In ICT, swings act as the skeleton of analysis. Everything else — liquidity, displacement, PD Arrays, entries — attaches to that skeleton. When the skeleton is strong, the entire analysis stands firm. When it is weak, nothing works consistently.

Master the swings, and market structure stops feeling complex. It becomes logical, repeatable, and easy to follow.

One of the most important ideas in ICT is that swing highs and swing lows work the same way on every timeframe. The market is fractal. This means the structure you see on a daily chart is also present on the 1H, 15m, or even lower timeframes — just in smaller form.

This is where many beginners get confused. They drop to a lower timeframe and suddenly see swings going in the opposite direction. Price looks bullish on the higher timeframe, but bearish on the lower timeframe. Panic starts. Bias changes. Confidence disappears.

The mistake is not understanding roles.

Higher timeframes define the truth. They show the real market intent, the dominant structure, and the overall narrative. These swings matter the most. If the higher timeframe is bullish, that bias does not change just because the lower timeframe shows a small pullback.

Lower timeframes exist to refine, not to decide. Their swings help you see detail inside the higher-timeframe idea. They show how price reacts, pauses, and delivers entries — but they should never override the higher-timeframe structure.

Higher timeframe swings tell you where the market is going.

Lower timeframe swings tell you how it is getting there.

A very common beginner mistake is letting lower timeframe swings change bias. This leads to counter-trend trades, early entries, and frustration. Small swings create noise when they are given too much authority.

When you respect fractals correctly, everything aligns. Structure stops contradicting itself. Swings make sense across charts. And trading becomes calm instead of reactive.

Most traders don’t struggle with swing highs and lows because the concept is difficult. They struggle because of how they apply it in real time. Small mistakes in swing marking slowly destroy clarity, and once clarity is gone, structure, liquidity, and entries all start to fail.

The most common mistake is marking every candle as a swing. Beginners often feel that if they don’t mark everything, they might miss something important. The result is the opposite. When every small pause becomes a swing, structure loses meaning and direction constantly flips.

Another damaging habit is changing swings after price moves. Traders mark a swing, price breaks it, and then they redraw the swing somewhere else to “make sense” of the move. This creates hindsight bias. Swings are meant to guide understanding, not to be adjusted to feel right after the fact.

Many beginners also try to use indicators to confirm swings. This completely defeats the purpose of ICT. Swing highs and lows are read directly from price. When indicators are involved, traders stop trusting their eyes and start waiting for confirmation that always comes late.

Ignoring the higher timeframe is another major issue. Lower timeframe swings are given too much importance, while higher timeframe structure is forgotten. This causes bias to change constantly and creates emotional decision-making.

Finally, some traders force bias from swings. Instead of observing what price is showing, they decide what they want the market to do and mark swings to support that idea. This leads to frustration when price does the opposite.

If swings are marked to support an opinion instead of to observe reality, structure will always feel confusing.

Correct swing marking requires patience, honesty, and repetition. When mistakes are reduced, clarity returns naturally.

Break of Structure (BOS) and Change of Character (CHoCH) only make sense when they are built on correct swing highs and swing lows. Without clear swings, BOS and CHoCH become meaningless labels that appear everywhere on the chart.

A BOS or CHoCH is not created by any random break. It happens only when a valid swing high or swing low is broken. If the swing itself is weak, forced, or unclear, the break carries no real information. This is why many beginners feel structure is inconsistent — they are reacting to candle breaks instead of swing breaks.

When price breaks a valid swing in the direction of the trend, it confirms continuation. This is BOS. When price fails to protect a key swing and breaks structure in the opposite direction, it signals a potential change in behavior. This is CHoCH. The quality of the swing determines the quality of the signal.

Swings also act as an early warning system. Before structure fully shifts, price often struggles to make new valid swings in the trend direction. Higher highs become weak. Higher lows fail to hold. This loss of swing strength often appears before a clear CHoCH forms.

No valid swing → no valid structure → no meaningful BOS or CHoCH.

This is why ICT follows a strict sequence:

Swing → Structure → Liquidity → Entry

Entries are always last. When swings are clear, BOS and CHoCH stop feeling random. They become logical checkpoints in the market narrative instead of signals to chase.

Not every price movement deserves to be marked as a swing. One of the biggest reasons structure becomes confusing is because traders mark swings in conditions where price is not making real decisions. In ICT, clarity comes from selective marking, not constant marking.

Low-volume ranges are a common trap. When the market is quiet, price often drifts back and forth without intent. These movements may look like swings, but they carry no real meaning. Marking swings in such conditions only adds noise and creates false structure.

News spikes should also be treated with caution. High-impact news can cause sharp, emotional price moves that look important in the moment. However, if price quickly retraces or ignores the level afterward, it was not a true swing. Real swings are respected by price beyond the initial reaction.

Choppy consolidations create another source of confusion. Price repeatedly moves up and down in a tight range, producing many small highs and lows. These are not institutional decision points. They are signs of indecision and balance.

Dead sessions, especially outside active market hours, often produce unreliable price action. Swings formed during these times rarely influence future structure.

Fewer swings marked correctly always create better structure than many swings marked poorly.

When you stop forcing swings and wait for clear intent, structure becomes stable and far easier to trust.

Before you use any swing high or swing low to define market structure, pause and run through this checklist. This simple habit protects you from forced analysis and emotional bias.

If even one answer is uncertain, the swing should not be trusted yet. Waiting is not a mistake — it is discipline. When swings pass this checklist, structure becomes clearer, bias stabilizes, and decision-making becomes calm and logical.

There is no fixed number of candles that create a valid swing in ICT. A swing is defined by price reaction and intent, not by candle count. Sometimes a swing forms with just a few strong candles, and other times it takes longer. What matters is whether price clearly changed direction and whether that level was respected afterward. If you are counting candles to justify a swing, you are already approaching it the wrong way.

The rules do not change, but the importance of swings does. Swing logic is the same on all timeframes, but higher-timeframe swings always carry more weight. Lower-timeframe swings are used for detail and refinement, not for defining overall bias. Beginners often struggle because they give too much authority to lower-timeframe swings and ignore higher-timeframe structure.

Yes. A swing can lose relevance if price no longer respects it. If price breaks through a swing level cleanly and continues without reaction, that swing is no longer valid for structure. This is normal and does not mean the swing was wrong at the time. Markets evolve, and structure updates as new information appears.

Equal highs and equal lows are primarily liquidity, not swings. They show where stop orders are likely resting. While they may form around previous swings, their main role is to highlight where price may be drawn to collect liquidity, not to define structure on their own.

Yes. Swing highs and swing lows are based on price behavior, and price behavior is consistent across markets. Forex, indices, and gold all move through institutional decision points. While volatility and session behavior may differ, the logic of swings remains the same everywhere.

If there is one concept that truly simplifies ICT, it is swing highs and swing lows. Swings are not a small detail — they are the starting point. When swings are clear, structure becomes readable. When structure is readable, liquidity makes sense. And when liquidity makes sense, entries stop feeling stressful or random.

Most confusion around ICT does not come from advanced concepts. It comes from a weak foundation. Incorrect swings create false BOS, fake CHoCH, confusing liquidity, and late entries. Once swings are marked correctly, much of that confusion simply disappears. The market starts to tell a clear story instead of sending mixed signals.

Mastering swings does not happen overnight. It requires repetition and patience. You must look at charts daily, mark only what is obvious, and resist the urge to force structure. Over time, your eyes adjust. You begin to see valid swings naturally, without hesitation or doubt. This is how skill is built in ICT — slowly and honestly.

After swings are understood, the next step is to learn how they connect into full market structure. This includes understanding BOS, CHoCH, and how narratives form across timeframes. Do not rush this process. Each layer of ICT builds on the previous one.

ICT rewards disciplined learners. The traders who move slowly, respect foundations, and focus on clarity are the ones who eventually trade with confidence. Swings are where that journey truly begins.

Why ICT Trading? Scope, Myths & Step-by-Step Smart Money Guide

January 24, 2026

Connect with focused ICT learners on our Telegram. Get daily insights, updates, and clear guidance to simplify your trading journey.

Join Channel